How Often Should You do an Estate Plan Review?

An Estate Plan Review Helps You Deal with Life Changes

A Qualified Personal Residence Trust (also known as a “ QPRT”) is an irrevocable trust which a homeowner establishes to make a future gift of his home to his or her children while retaining the right to continue living in the home for a defined number of years. At the end of that period, the home transfers to the remainder beneficiaries who are typically the homeowner’s children. The right to continue living in the home is the “retained interest” and the beneficiaries’ interest is the “remainder interest”. The remainder interest is a reportable gift and effectively removes the house from the homeowner’s taxable estate. The QPRT takes advantage of provisions in the tax law that allows the gift to be reported at a discounted value.

John Doe, a widower at age 67, owns his home which is worth $1 million. He has a life expectancy of 15.2 years. He expects that the house will be worth $1.5 million in 15.2 years. He has other assets which total over $5,325,000, the amount of the federal estate tax exemption. If he keeps his home until he dies, then it becomes part of his taxable estate and will be subject to estate tax of 35% on the $1.5 million value at his date of death. $1.5 million at the 35% tax rate would be $525,000. He wants to transfer the ownership of the home to his children and avoid the estate tax by getting it out of his estate. He establishes a QPRT which provides that he may live in the home for 10 years.

A Qualified Domestic Trust (also known as a “ QDOT”) is type of trust established where estate property passes to a non-U.S. citizen spouse to allow a marital deduction on the death of the first spouse. A QDOT allows the amount transferred into the Trust to qualify for the estate tax marital deduction. Without a QDOT, assets transferred from a decedent to a spouse who is a non-U.S. citizen do not qualify for the marital deduction on the decedent’s Federal Estate Tax return, form 709, and thus get taxed on the death of the spouse who is a U.S. citizen.

A Qualified Domestic Trust (also known as a “ QDOT”) is type of trust established where estate property passes to a non-U.S. citizen spouse to allow a marital deduction on the death of the first spouse. A QDOT allows the amount transferred into the Trust to qualify for the estate tax marital deduction. Without a QDOT, assets transferred from a decedent to a spouse who is a non-U.S. citizen do not qualify for the marital deduction on the decedent’s Federal Estate Tax return, form 709, and thus get taxed on the death of the spouse who is a U.S. citizen.

For a trust to qualify as a QDOT, the trust instrument requires that at least one trustee be a U.S. citizen or a domestic (U.S.) corporation and that no distribution of trust principal can be made unless that trustee has the right to withhold the tax imposed on QDOTs. A QDOT is authorized under the IRC §2056(d) and regulations thereunder governing the marital deduction for property passing to a surviving spouse.

According to the tax laws, IRC §671-679, a “grantor trust” is any trust in which the Trustor/Grantor retains control over the income or principal, or both to such an extent that he is regarded as the substantial owner of the trust property and income. The power to revoke is a typical retained power that makes a trust a grantor trust. Thus, the typical living trust used in estate planning is a revocable trust and hence a “grantor trust”. The income tax significance is that the taxable income generated by the grantor trust is reported on the income tax return form 1040 of the Trustor/Grantor. Also, the tax due on such income is paid by the Trustor/Grantor on his personal income tax return, form 1040. Thus, a grantor trust does not typically file any income tax return.

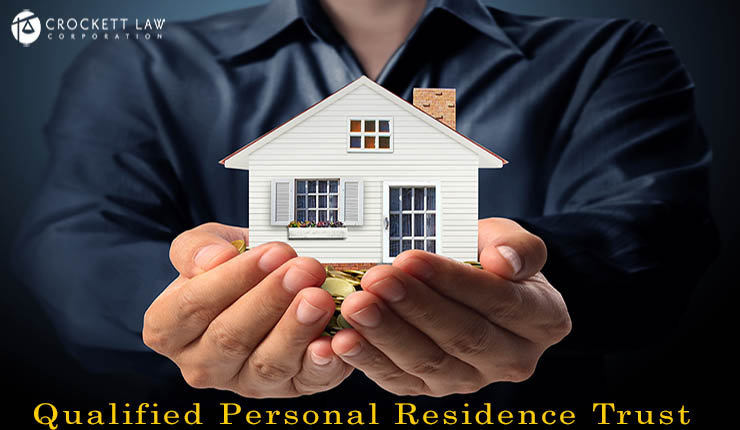

A Generation Skipping Trust (GST) is a generic term for any trust where there are trust benefits which are skipping a generation. A typical example is where a Trustor establishes a trust that does not benefit his children but instead benefits his grandchildren. Thus, the trust “skips” giving anything to the Trustor’s children. The law imposes a “Generation Skipping Tax” of a flat 40% on certain transfers above an exemption amount to insure that property transfers are subject to transfer tax at least once at each generation. The exemption amount is the same as the estate tax exemption amount which for 2014 is $5,325,000. The relevant IRC sections are §2601 through §2642.

A Generation Skipping Trust (GST) is a generic term for any trust where there are trust benefits which are skipping a generation. A typical example is where a Trustor establishes a trust that does not benefit his children but instead benefits his grandchildren. Thus, the trust “skips” giving anything to the Trustor’s children. The law imposes a “Generation Skipping Tax” of a flat 40% on certain transfers above an exemption amount to insure that property transfers are subject to transfer tax at least once at each generation. The exemption amount is the same as the estate tax exemption amount which for 2014 is $5,325,000. The relevant IRC sections are §2601 through §2642.

A Charitable Remainder Trust (also known as a “ CRT”) is a permanent, irrevocable trust that is established to pay an amount at least annually to the Trustor for a period of time and then at the end of that time pays the remainder in the trust to a charitable organization. The Trustor contributes assets to the CRT when it is established. The Trustor gets a current income tax deduction for the present value of the remainder interest and escapes capital gains tax on the assets placed in the trust. A CRT is established under the specific authority of Internal Revenue Code §664 and the regulations thereunder.

Frequently we run across situations where parents will leave their residences to one or more of their children in their will or their trust. If they only have one child then the situation is usually okay but when there are multiple children and some are living in the house and some are not there can be problems. Allowing some children to live in Mom’s house messes up the other sibling’s inheritance.

Irrevocable Life Insurance Trusts – These types of trusts are not often thought of as an asset protection device. However, they have many benefits, including:

A Will is a written document which states to whom a person’s belongings, money and property are to be given upon death. A Will is typically effective upon a person’s death and can be changed or replaced any time as long as the Will maker is mentally competent. People who die without wills are said to die “intestate” so their money and property passes under the laws of intestacy. Refer to my blog on “passing without any will.”

The wrong kind of deed can have expensive and unintended consequences. Once the horse is out of the barn you can get back!

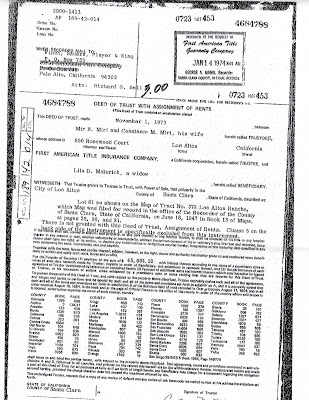

Real estate property ownership is legally changed by a document commonly known as a deed which is signed by the person making the ownership transfer. The deed is then recorded with the County recorder in the county where the property is located.

Real estate property ownership is legally changed by a document commonly known as a deed which is signed by the person making the ownership transfer. The deed is then recorded with the County recorder in the county where the property is located.